- What items are prohibited and can't be delivered through DHL easySHOP?

DHL easySHOP cannot deliver certain items for legal or safety reasons. Be sure to check the following information before you order a product! If you have any questions please contact us through LiveChat

Legal restrictions

Some products are prohibited due to exporting country, importing country or transportation regulations. In addition, items ultimately destined for Cuba, Iran, North Korea, Sudan, and Syria and any other country subject to US or international embargoes are prohibited. Also, shipments destined to certain prohibited persons and entities are also excluded from the DHL easySHOP service.

Safety restrictions

Products that cannot be safely shipped include flammable products or dangerous items, e.g., products that are toxic or that may catch fire or explode during shipment. This category includes some everyday products such as aerosols, perfumes and some cosmetics

What happens to prohibited items?

If you do order any item that cannot be legally or safely shipped, we will make every effort to advise you that we have received them and that we will not be able to ship them.

It is then your responsibility to:- arrange a return to the merchant, or

- advise us to dispose of the product.

If you order products that cannot be legally sold (such as marijuana or other illegal drugs), we are not able to return those items to the merchant or ship them to an alternative address. They are subject to seizure by law enforcement authorities.

CLICK ON THESE LINKS FOR THE DETAILED LISTS OF ITEMS THAT CANNOT BE DELIVERED

In these links, we have provided for your guidance detailed lists of products that cannot be shipped. We have tried to make the lists as complete as possible, but they are not necessarily exhaustive. There may be other items not specifically named which fall into one of the following categories.

UPDATE Samsung Note 7. We are not allowed to transport any Samsung Note 7.

NEW REGULATION

Lithium Batteries and Electronic Products that require them- LOOSE LITHIUM-ION BATTERIES

- I.E. - Power banks, Battery packs, cell phone batteries, laptop batteries.

- All external battery packs and power banks are NOT regulated to be shipped (those are prohibited).

LITHIUM-ION BATTERIES WITH EQUIPMENT

- Laptop with battery outside of laptop CAN ship, as long as battery is under 100 Wh and packaged with equipment (same box, inside of another box).

- Camera & camera battery CAN ship.

- Per NEW regulations only 1 battery per shipment

with equipment

. - Must be sent in box, no longer shipped inside of padded pouch or poly bag.

- Per NEW regulations only 1 battery per shipment

LITHIUM-ION INSIDE EQUIPMENT

- Regulations have not changed = iPhone, iPad, Kindle, Nook, etc…

LITHIUM-METAL IN EQUIPMENT

- All instances are prohibited

LITHIUM-METAL WITH EQUIPMENT

- All instances are prohibited

LOOSE LITHIUM-METAL

- All instances are prohibited

LITHIUM ION BATTERIES

with- over 2.7 Wh and less than 100 Wh per battery and more than two batteries per box, OR

- over 2.7 Wh and less than 100 Wh per battery and more than 8 cells per package.

LITHIUM METAL BATTERIES

with- over 0.3g lithium and less than 1g lithium per battery and more than two batteries per box, OR

- over 0.3g lithium and less than 1g lithium per battery and no more than 8 cells per box.

IMPORTANT! As you may know, there is a risk of certain lithium batteries catching fire. New regulations of the International Air Transport Association (IATA) in effect as of 1st April 2016 restrict the shipment of certain specific types of lithium batteries, which are considered "dangerous goods". Although not all lithium batteries are affected by these regulations, be sure to check your product specifications carefully against the restrictions below.

1st April 2016 - IATA RESTRICTIONS UPDATE:

1st January 2014 - IATA RESTRICTIONS UPDATE:

("Wh" means Watts per hour)

OTHERS RESTRICTIONS AND LIMITATIONS

are:- We will not ship any lithium batteries (ion or metal type) which are confirmed or suspected to be defective or damaged.

- We will screen the batteries in all electronic items at our export facility and will not be able to ship any items to you that fall into the above categories. That may mean that the product has to be returned to the merchant.

- More information is contained on these restrictions at http://www.iata.org/whatwedo/cargo/dgr/Pages/lithium-batteries.aspx

Cash, money and related items

- Cash (banknotes and coins)

- Travelers cheques

- Any monetary instrument in bearer form

- Counterfeit or imitation money

- Credit cards and credit card readers

Cigarettes & related products

- Cigarettes

- Cigars

- Tobacco

- Tobacco products including chewing tobacco

- E-Cigarettes or Vapes are not acceptable to certain countries. Contact us before ordering

Drugs

- Controlled chemicals, including substances which are precursors or chemicals for manufacture of dangerous drugs or psychotropic substances

- Narcotic drugs

- Unlicensed drugs including synthetic cannabis (often packaged as "herbal incense", "herbal potpourri" or similar descriptions)

- Infectious substances

Electronics

- Many electronic products require lithium batteries. New regulations as of 1st January 2014 restrict the shipment of certain types of lithium batteries. Please carefully check Lithium Batteries and Electronic Products that require them before you purchase any lithium batteries or electronic items that include lithium batteries.

- Certain radio transmitters and cordless phones not approved for use in your country

Sharp objects

- Axes

- Darts

- Bows and arrows

- Bayonets

- Knife

Firearms and Weapons

- Guns, including

- Revolvers

- Rifles

- Pistols and other firearms (or parts thereof)

- Starter pistols

- Rifle scopes

- Ammunition and associated products; bullets

- Offensive weapons, including

- Mace

- Pepper spray

- Stun guns

- Tasers

- Martial arts weapons

- Hand grenades

- Flick knives

- Throwing knives

- Brass knuckles, “knuckle dusters”

- Imitation weapons, including

- Toy guns

- Toy pistols

- Toy grenades

Gambling Items

- Gambling equipment and apparatus

- Poker chips

- Lottery tickets and other similar prize tickets

Miscellaneous

- Products / beverages containing alcohol

- Counterfeit or “pirated” goods; items that infringe intellectual property rights (trademarks, copyrights or patents)

- Documents and personal mail

- Religious books

- Ashes; human remains.

- Animal Products/Fur

- Any goods deemed to be offensive to the Muslim culture

- Many electronic products require lithium batteries. New regulations as of 1st January 2014 restrict the shipment of certain types of lithium batteries. Please carefully check Lithium Batteries and Electronic Products that require them before you purchase any lithium batteries or electronic items that include lithium batteries.

- Dead / Live Insects Completely Prohibited

Perishable products

- Frozen items, items requiring refrigeration

- Fresh flowers

- Living plants, trees, bushes

- Seeds

- Perishable foods (e.g., cheese, milk, yoghurt, eggs, meat, fish, seafood)

- Live bait

Precious metals & stones

- Bullion, gold and other precious metals

- Loose precious stones

- Gold, silver and platinum jewelry

- Antiques

- Rare coins

Explosive, Toxic and Dangerous Products

The following list only describes general categories of these types of products. It is not exhaustive. Each item has to be determined on a case-by-case basis, depending on the specific ingredients.

- Irradiating apparatus and radioactive materials

- Explosives including gunpowder and dynamite

- Firecrackers and fireworks

- Fire extinguishers

- Asbestos

- Cigarette lighters, gas lighters

- Poisons

- Magnets

- Hair regrowth products, e.g., Rogaine

- Goods that are potentially flammable, including

- Perfumes and Colognes

- Eau de toilette

- Fragrance spray

- Makeup remover

- Aftershave lotion

- Nail polish

- Nail polish remover

- Some hair care products

- Aerosols; any product in an aerosol can

- Compressed gas or gas cylinders

- Fuels

- Gasoline (petrol)

- Gas torches

- Engine oil

- Motor oil

- Essential oil

- Lighters with fuel; lighter fluid

- Turpentine

- Paint thinner

- Household cleaners

- Paint and paint guns

- Varnishes

- Stains

- Solvents

- Glue and adhesives

- Paintball tanks, guns and grenades

- Printer toner cartridges

- Laboratory chemicals

- Chimney cleaner

- Drain cleaner

- Oven cleaner

- Bleach

- Pesticides and fungicides

- Chlorofluorocarbons (CFCs)

- Antifreeze

- Automotive products, including

- Brake fluid

- Coolants

- Degreasers

- Hydraulic fluid

- Power steering fluid

- Transmission fluid

- Vehicle cleaning solutions

- Performance additives

- Lithium batteries: New regulations as of 1st January 2014 restrict the shipment of certain types of lithium batteries. Please carefully check Lithium Batteries and Electronic Products that require them before you purchase any lithium batteries or electronic items that include lithium batteries.

Unless they comply with the following packaging requirements:- Packages containing lithium batteries, or lithium batteries contained in, or packed with, equipment that are properly packaged

- Packing each battery or each battery-powered device when practicable, in fully enclosed inner packaging made of non-conductive material (such as a plastic bag)

- Separating or packing batteries in a manner to prevent contact with other batteries, devices or conductive materials (e.g., metal) in the packaging

- Ensuring exposed terminals or connectors are protected with non-conductive caps, non-conductive tape, or by other appropriate means

- Batteries should be securely cushioned and packed to prevent shifting which could loosen terminal caps or reorient the terminals to produce short circuits

Pornographic & Obscene Materials

- Sex toys, clothing, & equipment

- Pornographic material

- Erotic publications / videos / movies

- Erotic lubricants

Weapons & Warfare (Export Specifically Prohibited)

We are required to submit any items in this category for review by the government agency responsible for export compliance. Depending on their decision, the product may be

- seized by the agency for further investigation, or

- shipped to you if the agency decides it is legal to export it, or

- we will notify you that it needs to be returned to the merchant, shipped to another domestic address, or disposed of.

- Munitions of war

- Any products or intended for use or which could be used in chemical or biological weapons, missile technology, or nuclear proliferation

- Any items specially designed, modified, adapted or configured for military use and any "dual use" items (those with both commercial and military/police uses) including but not limited to

- Projection telescopes specially designed for use with Super High Power Laser ("SHPL") systems

- Handcuffs, leg cuffs, ankle cuffs, police-type batons

- Polygraph (lie-detector) equipment

- Military helmets

- Night vision equipment (e.g., goggles, binoculars)

- Bulletproof clothing; flak jackets

- Nuclear material

- Surveillance and eavesdropping equipment (including hidden cameras, infrared and thermal imaging cameras)

- Lasers, radar, sonar systems

- Telecommunications equipment designed to operate underwater, or at extremely high or low temperatures, or to withstand radiation

- Spraying or fogging systems

- Software used for active flight control purposes, or designed or modified to use "cryptography" employing digital techniques performing any cryptographic function other than authentication or digital signature; military encryption software; software employing a key length greater than 64 bits for the symetric algorithm

- Aircraft and aircraft parts

- Drones

- Any other goods subject to government export restrictions or requiring an export license

- Items destined for Cuba, Iran, North Korea, Sudan, and Syria and any other country subject to US or international embargoes

- Items addressed to US or international lists of prohibited persons and entities

For more information

On US export restrictions

Please see www.access.gpo.gov/bis/ear/ear_data.html and http://www.bis.doc.gov/exportlicensingqanda.htm.

On products subject to UK and EU export restrictions

You can register to use the "Goods checker" web-based search tool published by the UK Department for Business Innovation and Skills, https://www.ecochecker.trade.gov.uk/spirefox5live/fox/spire/OGEL_GOODS_CHECKER_LANDING_PAGE/new.

Import Restrictions

The above list consists of products that cannot be shipped to any country. In addition, some countries have specific import restrictions which are not included. For information on import prohibitions and restrictions, please check with the Border Control authority for your country.

- What is 'volumetric weight'?

We use volumetric weight when determining the weight of the shipments we send and we understand that this is not always an easy concept to grasp. We want to break down the details for you in order to make it as clear as possible.

The cost of transporting a shipment can be affected by the amount of space that it occupies on an aircraft, rather than the actual weight. This is the volumetric (or dimensional) weight.

The volumetric weight of a shipment is a calculation that reflects the density of a package. A less dense item generally occupies more volume of space, in comparison to its actual weight.

The volumetric or dimensional weight is calculated and compared with the actual weight of the shipment to ascertain which is greater; the higher weight is used to calculate the shipment cost.

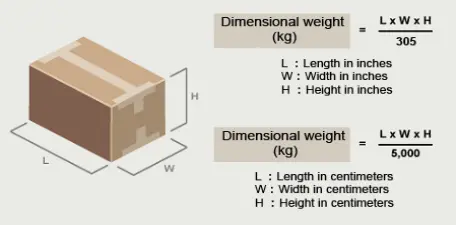

Calculating Volumetric Weight

Volumetric weight is calculated by multiplying the length x height x width of a package and dividing the result by a volumetric factor.

That factor varies with the unit of measure. Since we use kilograms to calculate shipping charges, we use the following formulas to calculate volumetric weight:

Please be aware that the shipping weight indicated on your merchant order confirmation may be based on ground shipping or domestic air shipping from the merchant to our hub location.

Depending on the carrier and size of package, the Merchant's ground shipping charges may or may not utilise volumetric weight calculation.

If the carrier used by the Merchant does use volumetric weight calculation for ground or for domestic air, the volumetric weight calculation will use a different volumetric factor and the volumetric weight will be lower than that used for international air shipments.

We hope this helps to make volumetric weight a little bit easier to understand.

Please feel free to contact customer service with any additional question.

- Do you consolidate items into one package?

We do not consolidate packages into one box. We ship the packages as they arrive from the merchant. All goods are shipped as individual boxes.

We may, at your request, consolidate several packages into a single shipment, which will save costs. See FAQ What are the benefits of consolidating packages?

- Can I split items in a package?

It is not possible to split individual boxes, as we received them from the merchants.

We do, however, repack certain items to save on shipping costs. See FAQ What is the repacking service?.

- Do I really have to pay tax and duty?

Yes you do - and there are heavy fines or even criminal proceedings for anyone trying to evade import taxes and duties.

You are the "Importer" for your purchases and you are responsible for an accurate declaration of the nature of the goods and their value. This information is used to determine taxes and duties by your local Customs Authority. You can verify the accuracy of any shipment in your suite by logging into your suite and reviewing the details for items waiting to be shipped. All imported goods must be declared to customs - regardless of whether the goods are new or used or whether you are buying them for yourself or as a gift. Some countries set a value threshold under which they do not collect duty or tax ("de minimis" value). If your shipment is under this threshold, DHL easySHOP will not collect any payment from you for duty or tax. However, you should be aware that Customs reserves the right to revalue or reclassify items which are imported. If this occurs, you may be liable to pay the additional amount upon delivery.

If you are not sure whether your goods will be liable for local duties and taxes please contact us via Chat.

Local sales or other taxes may also apply for domestic deliveries from the Merchant to your DHL easySHOP Suite address. These will show up in your record of the purchase transaction before you make your payment to the Merchant.

Sometimes merchants don’t include an invoice or packing slip with the package. In this situation, you will receive a message from us asking you to upload the invoice and payment receipt you received from the merchant at the time of purpose.

BE AWARE: Some unscrupulous Merchants imply on their websites that they will either mis-describe items or under-declare their value in order to evade customs charges. However, we emphasise that you as the "Importer" are legally responsible for the accurate declaration of the goods and their value for assessment of tax and duty in the importing country. So although the Merchant may produce a commercial invoice, you are legally responsible for the information on the customs declaration and for any customs duties and taxes that may be due. This means that if you purchase goods from these Merchants, and the declaration is found to be false or misleading, you may be liable for financial penalties or even criminal prosecution and having your goods confiscated by Customs. DHL easySHOP is not responsible for any mis-statements of duty or tax, whether by you or the Merchant.

- How do I track my shipment?

We will email you with various progress messages:

- 1. As soon as your goods have arrived at your DHL easySHOP suite address

- 2. On arrival at the Middle East processing centre

We will also email you if there are any problems with a specific package:

- Contains prohibited or restricted goods (See our FAQ)

- No invoice or packing list from the merchant

Once a package has arrived at the Middle East processing center you can then either choose to have them prepared for shipping straight away or wait until other purchases have arrived and send them all in the same consolidated shipment.

We email you to let you know when your goods are shipped. This final message will include the DHL Express waybill and you can track this as normal through www.dhl.com

- How long does delivery take?

When you order your goods from a global retail website, the Merchant will normally take 2-3 days to deliver it to your DHL easySHOP Suite address. The time interval will depend on which of the Merchant's shipping methods you select. This is outside of our control.

Once a package has arrived at any of your DHL easySHOP suite addresses it will take between 4 and 6 days before it will be delivered.

If you choose to consolidate your shipments then delivery will take longer since we need to wait until all the packages have arrived

These are estimates, not guarantees; shipping time can vary depending on factors such as weather, possible customs delays, and whether the delivery address is in a city or a remote area.

The longest part of the delivery process is often the final mile (or kilometer) delivery to your address.

If you are normally out during the day, we can deliver your shipment to your place of work or to a friend – when your package(s) are leaving our Middle East processing center you will be able to use DHL’s “On Demand Delivery” service to change the delivery location

For more information, please contact our Customer Service team.

- When will you process my shipment?

At our site in the USA our operations team process shipments Monday to Friday 09h00 to 18h00 local time.

At our site in the UK our operations team process shipments Monday to Friday 08h00 to 17h00 local time.

- How do I change my delivery address?

To change your delivery address, log in to your DHL easySHOP account, and then click on 'My Address book'.

By clicking on 'edit' you can change your address.

When you change your delivery address, all future items will then be delivered to that address.

The new address need to be validated before you can release a shipment.

- How do I convert pounds to kilos?

- To convert lbs to kilos, divide the number of lbs by 2.2046

- For example: 22lbs divided by 2.2 = 10kg

- What happens if my goods arrived damaged at my DHL easySHOP suite?

DHL easySHOP may refuse to receive any package that shows obvious external signs of damage or missing contents. If that happens, the package will be rejected and returned to the sender, and we will notify you.

DHL easySHOP doesn't have the responsibility to inspect the contents of every package for determining the condition of the goods when they are received at your DHL easySHOP suite.

If during inspection and handling, we notice any signal of damage in your packages, we will notify you via email about the damage conditions. You should then contact the Merchant directly to arrange an exchange/refund and let us know what you wish to do through the Customer Service page.

If you see a 'Damaged' icon against your delivery, you will not be able to have it shipped unless you specifically authorise us to do so (ensuring that you don't choose to receive damaged goods inadvertently). If do decide to ship a damaged product, please contact DHL easySHOP Customer Service to arrange for the shipment.

Return fees may apply for returning a Damaged item from our export hub to the merchant, unless a prepaid return label is provided or collection by the merchant.

You will need to communicate directly with the merchant about return shipping charges and refunds.

- Can you refuse a delivery for me?

We receive deliveries, in bulk, from all the major carriers and local post networks. At the time of taking delivery it is seldom possible to identify one carton.

We are not able to refuse delivery on request.

Sometimes we can and will refuse a delivery if, from the outside of the package, it is obvious that the contents are damaged. See our FAQ What happens if you receive my goods and they are damaged?

- I can see that my goods have been delivered, but they have not been updated into my suite yet?

Due to the high volume of deliveries we receive at the various DHL easySHOP processing sites and the time differences, please allow one working day for any deliveries to be updated into your suite.

Our busiest day is Monday which is when we receive the highest number of packages.

- What is the maximum size of package I can receive?

Packages must not exceed 47x31x63 inches / 120x80x80cms OR weigh more than 154lbs / 70kgs

If you anticipate that the goods you are ordering could come in a package that is larger/heavier than this, please speak to the Merchant to see if they can help to reduce the packaging or weight. Bear in mind that fragile goods such as electronic equipment, glassware etc may come with a lot of packaging so the parcel may be larger than you expect.

If you expect a package larger than the above please do not hesitate to contact us

- Do goods have to be delivered to my billing address?

Once any package is entering the DHL Express network and you have your waybill number you will get an email alert from our On Demand Delivery service which will allow you to select the easiest delivery option for you

Before you specify another delivery address, please make sure the alternate address is valid. If we cannot validate your new shipping address, we will revert back to the last valid address for your account.

Bear in mind that goods may need to be signed for, so do choose an address where there will be someone available to sign for them during the day.

- How do I calculate my shipping charges in advance?

We encourage you to use DHL easySHOP Shipping Cost Calculator, which you can use to estimate the international shipping costs, duty and taxes before you order the item from the Merchant. Note that the total cost that will be displayed in advance of your purchase is only an estimate, not a guarantee.

Unfortunately, it is impossible to determine the exact charges in advance, as we do not know the size and weight of the parcel coming from the Merchant, and the Merchant's website often does not include that information.

- Which DVDs are prohibited?

The Customs authorities of your country may deny entry on any DVD.

General guidelines:

All G, PG, PG-13 and R (rated for violence/language) are usually permitted

R (rated for sexual content) and NC-17 are more likely to be prohibited

Some DVDs do not have a "rating", and Customs in some countries may deny entry based on their determination that the DVD is prohibited.

DHL easySHOP may refuse to ship any DVD which is likely to be denied entry to a particular country, and we will notify you by email.

- Can I ship Perfumes?

No, we are not currently able to ship perfumes or colognes at this point in time

- Can I move shipments greater than 70kg through DHL easySHOP?

No, it is not possible, but please read our FAQ page on Maximum weight and dimensions

- Can you deliver to any address?

We do deliver to most street addresses (not to PO boxes, however). However, if you live in a remote area, you may need to pick up your package from your closest DHL Express Service Point.

The final alert you will get from DHL easySHOP will be for any changes to your delivery address from our ‘On Demand Delivery’ platform

The following options will be given to you:

SCHEDULE YOUR DELIVERY

You can change the delivery date of your shipment if the originally scheduled date is not convenient for you.

SIGNATURE RELEASE

You can authorize us to leave your shipment without collecting a signature if you are absent when we attempt delivery.

LEAVE YOUR SIGNATURE

By leaving a signed authorization form at your front door on the morning of the day of delivery, you can authorize us to leave your shipment if you are absent when we attempt delivery.

LEAVE WITH NEIGHBOR

You can authorize us to leave your shipment with an immediate neighbor if you are absent when we attempt delivery.

COLLECT FROM SERVICE POINT

You can choose to collect your shipment at a DHL or DHL Partner Service Point convenient for you.

ALTERNATE ADDRESS

You can authorize us to deliver the shipment to a different address (for example, your workplace). Please note that a change of address will result in at least one additional day for delivery.

VACATION HOLD

If you'll be away on holiday, you can change the delivery date up to 30 calendar days from the originally scheduled date.

Please note that not all countries offer all of these options

- What happens if I am not in when the parcel arrives?

If we are unable to obtain a signature when we try to deliver we will make one more attempt for delivery at a later date. If this delivery attempt is also unsuccessful, a calling card will be left and your parcel will be held at DHL Express Service Center.

You can also logon to our ‘On Demand Delivery’ platform to make alternative delivery arrangements.

- What is emergency situation surcharge? Why are we creating this surcharge?

DHL Express transports your shipments around the world using our own fleet of dedicated DHL cargo aircraft, supported by significant amounts of commercial air cargo purchased on passenger flights. This unique model provides the coverage, capacity and service levels that you, have come to expect, connecting all 220+ countries and territories worldwide.

You will all have seen in the news or experienced firsthand the dramatic impact the current COVID-19 crisis is having on the global aviation industry, resulting in significant reductions or complete cancellation of passenger flights in most countries.

Our Global Network teams have been working around the clock to react and adjust our network, adapting it to reflect the changes in capacity and demand resulting from the global upheaval. The massive reduction in available commercial air cargo capacity and destinations has necessitated a switch to more indirect routings and the purchase of additional cargo aircraft lift, which is in high demand.

These factors, among others, increase our costs during this period to unsustainable levels.

This Emergency Situation Surcharge will allow us to cover part of the operating cost increases and the necessary air network adjustments during the time of this emergency situation.

Please find below the mechanism of this surcharge:

WHEN WILL THE SURCHARGE TAKE EFFECT?

The Emergency Situation Surcharge will be effective 27TH of April until further notice.

IN WHAT INSTANCES WILL THE SURCHARGE APPLY?

The Emergency Situation Surcharge will be applicable to all Time Definite International (TDI) shipments.

LATEST NETWORK UPDATES

To help you keeping up to date on our operations in impacted countries, you will find via the link below the latest update on our network status:

https://www.simplydhl.com/covid-19updates

This website will be updated twice per week. In case you need further specific detail about the actual operational status in your country, please contact your account manager or customer service representative.

DHL Express will continue to make necessary adjustments to ensure we remain a reliable partner for all your express shipping needs. We will also continue to inform you about any major changes in our service offering.

- EORI/VAT requirements in UK for the high value shipments with value of 800 GBP and more?

EORI is Economic Operator Registration & Identification, assigned by Customs in UK to individuals and business shipping commercially outside of the EU. If you are not EORI registered, HMRC will require for you to apply for an EORI to track commercial imports and exports leaving or entering the EU from a UK shipping address.

Please find the link below if needed to apply for an EORI number without being VAT registered: https://online.hmrc.gov.uk/shortforms/form/EORINonVATExport

If your VAT number is not EORI registered, HMRC can validate your VAT number for EORI purposes using the link below: https://www.tax.service.gov.uk/shortforms/form/EORIVAT

Please can you complete the online application and forward the automated response email from HMRC to us with their reference number on. By supplying this reference number it will enable us to complete the entry to customs without waiting for your EORI to become valid.

- Can I order items from merchants located outside the country of my DHL EasyShop address?

No, unfortunately, you cannot. easySHOP is designed to facilitate shopping from merchants within the same country as your provided easySHOP address. If an item is ordered from a merchant located outside of that country, our warehouse will not be able to accept the delivery.

- Placing an order with your DHL easySHOP virtual address

Tips on filling out online forms

To ensure that your orders are processed as quickly as possible, here are a few tips on filling out online forms to ensure you receive your items as soon as possible!

Billing Address

Billing AddressMust match the address on the payment card

Delivery Address

Delivery AddressThis is where you fill in your DHL easySHOP virtual address, starting with the suite number

We hope these tips have been helpful, please let us know if you have any additional questions, we're always happy to answer them!

- How do I return items to the merchant?

DHL easySHOP will help you to return an item to the merchant that you have purchased from.

- Can I use my DHL easySHOP address for purchases through eBay in the US?

Absolutely. You only have to add your DHL easySHOP address to your eBay postal addresses as follows:

- Go to My eBay

- Go to My Account

- Go to My addresses

- Click on 'View all postal addresses'

- Then add your DHL easySHOP US address. Make sure to include your Suite Number, Street Name, Number, etc.

REMEMBER TO UNTICK the box 'Make this my primary postal address', and then click 'Add New Address'.

Now you are able to receive your goods!

Congratulations!

- Can I use my DHL easySHOP address for purchases through Amazon in the US?

Absolutely. You only have to add your DHL easySHOP address to your Amazon postal addresses as follows:

- Go to Amazon.com

- Sign in

- Go to My Account

- Go to Settings > Add a New Address

- Then add your DHL easySHOP US address. Make sure to include your Suite Number, Street Name, Number, etc.

REMEMBER TO SELECT your DHL easySHOP address as the ‘Shipping address’ of your order and your default one as the ‘Billing address’ during the last step of the process.

Now you are able to receive your goods!

Congratulations!

- Can the Merchant describe the goods as a gift to avoid Duties and Taxes?

Absolutely not!

It is illegal for you and for merchants to describe the goods as "a gift" to avoid duties and taxes. Be aware of the legal problems it would create for you, your merchants and DHL easySHOP.

You are the "Importer" of the goods and responsible for accurate statements describing the goods and their respective value. Duty and taxes are based on these descriptions. We may be required to terminate your account if we learn of any mis-statement on your part.

Our Customer Service team will be glad to guide you if you still have doubts on this serious matter.

- I can't get through to the Merchant overseas!

Make sure you are dialling the right number:

- First you need to dial the international dialling access code - usually a '+' or '00'

- Then you need to dial the country code - for example 1 for the US or 44 for the UK

For a UK Merchant, if the phone number is

0207 xxx xxxx, then to dial it from overseas you need to drop the 0 at the beginning and dial00 44 207 xxx xxxxor+44 207 xxx xxxx.For a US Merchant, if the phone number is

213 111 2222then to dial it from overseas you will need to dial00 1 213 111 2222or+1 213 111 2222.Numbers which begin 1-800 or 800 are free call numbers in the US, and numbers which begin 0800 or 08xx in the UK are free call numbers. These numbers do not always work when you dial from outside the country. Or you may get a message advising you that the call is not free and will be charged at international rates. If you are unable to get through to your Merchant's free phone number , you should look for another number on their website, or send the Merchant an email asking for another number.

If you have a Skype account, you can make international calls using Skype credits.

You can find out more about international dialing at http://www.timeanddate.com/worldclock/dialing.html

- What should I do if my DHL easySHOP address is not accepted with a US online merchant?

On occasion, when entering your US shipping address at checkout at selected US online Merchants, you may receive something like the following message: "the street name or number appears to be invalid", or a message that asks you to "Confirm" the address. If this happens, try submitting the address a second time.

Remember: your DHL easySHOP Suite Number is essential to ensure delivery of your goods. Depending on the Merchant you are buying from, you may have to enter it after your name, or in address line 1. Or you may need to reverse the information in lines 1 and 2 of your suite address. If you are getting an error message, try replacing the hyphen (-) between the two numbers with a space.

If trying this does not work, contact us. Our Customer Service team would be glad to assist you.

- Your easySHOP address @Amazon

- Your easySHOP address @eBay

- Which currency is used for payments?

You pay the Merchant in the currency of their country (e.g. US Merchants will charge in dollars).

When you view your DHL easySHOP account, you will see the duty, tax and shipping/handling charges shown in the local currency for the country from which you bought the goods. This allows you to add the shipping/handling, tax and duty charges to the price of your goods to calculate the full delivered costs.

You can also opt to see the costs converted to your local currency, using the conversion rate of the day, so for example, UK customers will see their charges in UK Sterling, and for Malaysian customers the charges will be shown in Malay Ringgit. Please bear in mind that your bank or credit card company may use a different exchange rate and that exchange rates can and do vary from day to day.

- Can I pay US stores with a non US credit card?

Using a non US credit card

Check whether the store accepts non US credit cards when you checkout from their site. Some stores accept certain international credit cards but will only ship to a US address.

Pre-Paid Cards

Search the web for companies providing pre-paid or top-up credit cards. Buy one and have it registered to your DHL easySHOP shipping address.

Virtual Gift Cards

You can buy virtual gift cards of various values from many department stores with your non US credit card. Remember to provide your DHL easySHOP US shipping address when completing the store's registration

Click here for an example of a virtual gift card.PayPal

An increasing number of shops are accepting PayPal.

Click here for a list.Phone Payments

Many shops will let you pay by phone with a non US credit card so long as you have a US shipping address.

Click here for an example. Read the section at the bottom of the page - Need Assistance.

- What are the DHL easySHOP payment options?

DHL easySHOP accepts the following payment options:

For security reasons, please note that we can't accept cards that are expiring the same month as the payment date.

- Can I get an invoice for my shipping charges?

A printable invoice for your shipment is available when you log in to your DHL easySHOP account and click on 'Shipment history' - just click on 'Invoice' next to the Order number.

- What is the duty free limit for imports?

The unique DHL easySHOP Total Cost Calculator can give you an estimate of what you will have to pay, but its accuracy depends on the information supplied.

An example of a Tax and Duty calculation for an import from anywhere in the world to Kuwait when using DHL easySHOP would be:

5% on CIF + 1.5 KWD

Example:

Goods Paid Price = US$100

Freight Charges = 30 US$ (Freight value must be declared on waybill)

Insurance C&F = (100+30)*1%= 131.3 $

Total duty value= US$131.3*5%=US$6.5

Conversion to KWD= US$ 6.5 * 0.3 = 1.95 KWD

1.95 KWD + 1.5 KWD= 3.45 KWD

Total Duty Payable: 3.45 KWD

The value obtained from the Total Cost Calculator may be higher or lower than the actual total cost due, for example, to differences between estimated and actual currency exchange rates, package weights, product classification or value, and/or volumetric weight calculations for bulky, lightweight packages. See FAQ What is 'volumetric weight'?

Notes:

- All above charges might vary at any point of time as per Kuwait Customs

- All Duty Exempt Items will be charged only 1.5 KWD

- How do I pay tax and duty?

All imported goods must be declared to the importing country's customs office - failure to do this most likely result in your goods being impounded and could even result in a heavy fine or criminal proceedings. DHL easySHOP makes calculating and paying import duties easy, as you simply pay us for all the taxes, duty and shipping costs, and we pass on the relevant payments to customs.

DHL easySHOP calculates the tax and duty for you based on the information you provide about the product and its value. It is very important that the information be accurate and complete. See FAQ How is customs duty calculated?

DHL easySHOP makes paying import duties and tax easy, as you simply pay us for all the taxes, duty and shipping costs, and we pass on the relevant payments to customs.

Many countries have a duty free concession where goods below a certain value can be imported without duty and/or tax. See FAQ What is the duty free limit for imports?

- How do I know how much tax and duty I will have to pay?

The unique DHL easySHOP Total Cost Calculator can give you an estimate of what you will have to pay, but its accuracy depends on the information supplied.

An example of a Tax and Duty calculation for an import from anywhere in the world to Kuwait when using DHL easySHOP would be:

5% on CIF + 1.5 KWD

Example:

Goods Paid Price = US$100

Freight Charges = 30 US$ (Freight value must be declared on waybill)

Insurance C&F = (100+30)*1%= 131.3 $

Total duty value= US$131.3*5%=US$6.5

Conversion to KWD= US$ 6.5 * 0.3 = 1.95 KWD

1.95 KWD + 1.5 KWD= 3.45 KWD

Total Duty Payable: 3.45 KWD

The value obtained from the Total Cost Calculator may be higher or lower than the actual total cost due, for example, to differences between estimated and actual currency exchange rates, package weights, product classification or value, and/or volumetric weight calculations for bulky, lightweight packages. See FAQ What is 'volumetric weight'?

Download this compensation form and e-mail it, together with proof of purchases and good quality pictures if you want to make a claim, to easyshop.claims@dhl.com

- What is a Fuel Surcharge and why do I have to pay it?

Nearly all transportation carriers have instituted fuel surcharges to account for the wide fluctuations that are experienced in the cost of fuel, a major cost for transportation providers. Although DHL easySHOP goes to great lengths to negotiate the best possible rates, nearly all carriers reserve the right to add a fuel surcharge to the rates we pay. This surcharge will vary based on a set formula related to the price of fuel and may increase or decrease throughout the year. Because of the variability, DHL easySHOP does not have a standard fuel Surcharge but the current amount is available for you in the DHL easySHOP Shipping Cost Calculator.

- How is customs duty calculated?

DHL easySHOP calculates the customs payment amount based on the merchant's invoice. Sometimes merchants do not include an invoice or packing slip with the package, and if that is the case, we will contact you and ask you to send us the merchant invoice and payment receipt you received when you made your purchase. We cannot clear your package through customs without this.

Important: As the "Importer", you are responsible for declaring an accurate value because it determines the customs duty and import tax you will need to pay. We need to know the actual value to insert into the customs declaration on your behalf. If the value is not correct, the item may be held by customs, and you may be liable for additional costs and/or customs fines or penalties.

Please note that we are unable to change any values after you have authorised us to send the shipment.

- What if I do not have enough money to pay for shipment of goods from my DHL easySHOP address?

We will not be able to release your goods without payment. If your transaction is denied by your card issuer or payment service provider, you will need to contact them directly to arrange for funds to be available (or use another payment card) before submitting a further shipment release request

We will store your goods for free for 14 days, but after that we will have to charge you - see How long will you store goods in my Suite?.

- Can I claim back VAT/GST?

If you are registered for VAT/GST in your country, we recommend you to contact your Local Customs offices and ask whether and how you can recover it. They should give you the steps to be followed.

Be aware that duty, shipping and handling costs cannot be recovered.

If you need further assistance, please contact our Customer Service team.

- Why was my credit card declined?

There are a few possible reasons why your credit card might have been declined. We recommend contacting your credit card provider by telephone for further information.

- What is a security code/card verification number?

All credit and debit cards carry a security code number. This number is known to the bank and printed on the card, but is not stored or printed anywhere else. Therefore, it can be used as a check that when you make your purchase you are in physical possession of the card, or have at least seen the card at some time. On most cards, the security code number is the last three digits of the number printed on the back, at the top right of the signature strip. You will be required to enter this additional security number before your transaction can be completed.

*American Express puts the number on the front of the card above the credit card account number.

MASTERCARD, VISA:the last 3 digits of the number printed on the back of your card

AMERICAN EXPRESS:the 4 digits printed on the front of the card, on the right side.

- What is Shipment Insurance?

Shipment Insurance is an insurance option from DHL easySHOP providing opt-in protection for your goods in transit from our hub to you. It provides the assurance and peace of mind that your purchases are protected in the event of loss or damage in transit.

DHL easySHOP’s Shipment Insurance program does not cover any of the following:

- loss or damage to the package sent by the seller to our export facility

- indirect loss or damage

- loss or damage caused by delays

- values in excess of US25,000 (or equivalent in other currency)

- How do I select Shipment Insurance and how much does it cost?

Selection is easy. Just check the box on the shipment release page.

The insurance premium you pay is 2% of the combined value of the goods and shipping charges, with a minimum of KWD 2.00.

It will be automatically added to your invoice.

- My shipment has not arrived and I think that it is lost. What should I do?

Firstly, check the status of your order online by choosing Shipment history in your account and click on the tracking link for the shipment that you are tracking.

Please contact easySHOP's customer service team to investigate any delays on your behalf and we will quickly examine this further for you.

- My shipment has arrived damaged. What should I do?

If your shipment arrives clearly damaged, please make a note on the receipt that our courier requires you to sign. Then open the package and carefully check your goods for signs of damage

If they do prove to be damaged, please complete and return the DHL easySHOPcompensation claim form to easyshop.claims@dhl.com together with your original purchase invoice and good quality pictures if the order is damaged. Please note that you must contact us within 7 days of delivery.

In the case of damaged electronic equipment, you might be requested to provide a document proving that the equipment cannot be repaired.

Don't forget to keep all damaged goods and their packaging as you may be required to return these to us.

This protection does not cover loss or damage that is caused by:

- Your own wilful misconduct

- Ordinary wear and tear

- Delay, however caused

- Electrical fault or non operation of the goods in the absence of any visible damage

- Does Shipment Insurance cover the late delivery of my shipment?

No, our Shipment Insurance service only covers loss or damage. It does not cover the late delivery of your shipment. We do our very best to ensure prompt delivery of all purchases; however if your shipment has not arrived, check the status of your order online by choosing Delivery Status in your account and clicking on the tracking link for the shipment that you are tracking.

Please contact the DHL easySHOP Customer Service team to investigate any delays on your behalf and we will quickly examine this further for you. If it appears that your shipment is lost, we will advise you to make a claim.

- How do I make a claim?

Download this compensation form and e-mail it, together with proof of purchases and good quality pictures if the order is damaged, to easyshop.claims@dhl.com.

In the case of a damaged electronic equipment, you might be requested to provide a document proving that the equipment cannot be repaired.

Customer service is a priority for us and we aim to provide a quick resolution of all claims. We are committed to processing every claim as soon as we possibly can, and will deal with them just as soon as we can.

- Why do I need to keep the packaging?

The damaged packaging provides clear evidence for our claims handlers to assess each issue on a case-by-case basis, and it enables a quick resolution for our valued customers.

- How do I arrange the return of my damaged goods?

DHL easySHOP will arrange for a courier to pick up any damaged item you received in order to be returned to the merchant you purchased from

For more information about the costs involved, please review the "How Do I Return Items" section.

- What is the maximum value of shipments that the Shipment Insurance product will cover?

Your shipment is covered at 2% of the value of the goods and transport with a minimum charge of KWD 2.000.

You must notify us in advance if you require insurance on shipments with a value over US25,000 or equivalent currency.

- My electronic / digital device doesn't work, but it doesn't show any visible signs of damage. What should I do?

Shipment Insurance will only cover purchases that show clear, visible damage.

Also, check the FAQ Will electrical products bought overseas work here? for information on voltage requirements and adaptors.

If the product doesn't work at all, you may need to contact the Merchant. Consult the FAQ How do I return or exchange items?

- Must I enter my Suite number in the shipping address field when I place my order?

Yes - your Suite number is your unique identifier and the primary means to identify you as a DHL easySHOP customer when your package arrives at our export hub. Along with your suite number, the DHL easySHOP shipping address can be found when you log into your account and click on 'My suite addresses'. The format shown on this page is the most common address format used by merchants. However, this can vary from merchant to merchant

Your Suite Number is very important and you may have to enter your it after your name or in address line 1 depending upon the Merchant. Some Merchants also do not accept the hyphen (-) between the two numbers, in which case, please enter a space.

If a Suite number is not included on the delivery address, we may have difficulty identifying that it is your package and additional fees may apply

If you are expecting a package but haven't received a "New Delivery" notice from DHL easySHOP, contact Customer Support. That will help us locate your package if the Merchant didn't include the correct Suite number on the address label.

Items that are not identified after 90 days will be disposed of as permitted by law.

- How long will you store goods in my Suite?

Your deliveries will be stored in your Suite, free of charge, for up to 14 days for each parcel.

After 14 days, each parcel can be stored for an additional 30 days for a charge of:

- From the 15th day of storage to the 30th day, a charge of 3 USD per piece per day will be applicable;

- From the 31st day of storage to the 45th day, a charge of 5 USD per piece per day will be applicable.

Please understand that the maximum storage period is 45 days, after that your shipments will be removed and disposed Immediately.

We will send you email reminders before your 14-day free storage period ends, before your paid 30-day storage period ends, and again if your 45-days of storage period expires.

- What are DHL easySHOP's Hours of Operation?

Customer Support

DHL easySHOP Customer Service team is available from Sunday to Thursday 8:00 am to 5:00 pm. Friday 01:00 pm to 05:00 pm Saturday 09:00 am to 03:00 pm

Receiving Parcels

Our operations team processes parcels (local hub time):

United States Hub United Kingdom Hub Monday to Friday

9 a.m. to 6 p.m.Monday to Friday

8 a.m. to 5 p.m.Shipping Parcels

Our operations team releases parcels Monday through Friday.

Hub Closures

DHL easySHOP values each and every one of its employees. For national holidays, we close our export facilities so that our staff can spend time with friends and family. On these days, packages will not be received or shipped. Upon reopening, we will do our best to ship packages as quickly and efficiently as possible. Please refer to the following table for hub closure dates.

United States Hub United Kingdom Hub - 1 January: New Year Day

- 17 January: MLK JR Day

- 30 May: Memorial Day

- 4 July: Independence Day

- 5 September: Labor Day

- 24 November: Thanksgiving Day

- 25 December: Christmas Day

- 26 December: Christmas Day

- 1 January: New Year

- 2 January: New Year

- 3 January: New Year

- 4 January: New Year

- 15 April: Good Friday

- 18 April: Easter Monday

- 19 April: Easter Tuesday

- 2 May: May Bank Holiday

- 2 June: Spring Bank Holiday

- 3 June: Platinum Jubilee

- 10 June: Bank Holiday

- 5 July: Tynwald Day

- 12 July: Battle of the Boyne Day

- 29 August: Summer Bank Holiday

- 26 December: Christmas Day

- 27 December: Boxing Day

Holiday Season

There are three peak shopping periods that impact the Middle East.

Holy Month of Ramada: Sun – Thu. ( 8 am – 6:30 pm ) ( 7:30 pm – 9 pm). ( 6:30 – 7:30 pm break)

Friday & Saturday ( 9 am – 5 pm)

10 days prior to Eid Al AdhaGlobal peak of November and December. due to online year-end sales events.

During these periods the number of parcels received and shipped significantly increase. We suggest that our customers order early and then release packages as early as possible to receive their parcels on or before a particular date.

- The estimated value of my delivery is wrong. How can I change it?

If the package doesn't include an invoice or packing slip showing the amount paid for the item, we notify you of an estimated value and will request you to send us a copy of your online order confirmation from the merchant. It is your responsibility to ensure that the value of the item is accurately stated for customs purposes.

If you would like to correct the value of your delivery, please email us a copy of the order confirmation from the Merchant, and we will be happy do so. (Please click on the 'Send us an Email' link on the Customer Service page).

For detailed information, see FAQ How is customs duty calculated?.

Please note that we are unable to change any values after you have authorised us to send the shipment.

Important: You have the responsibility to ensure that the value of the item is accurately stated for customs purposes. If the value is not correct, the item may be held by customs and you may be liable for additional costs and/or customs fines or penalties.

- Help! I can't get into my account!

Make sure you have entered your account number accurately in the format 0000-0000. Enter the number in this way in the login box, including the hyphen (-), then your password and click 'Login'.

If you've forgotten your account number or password click here.

You can also log into your account by entering either your suite number or the email address you used to register with DHL easySHOP.

If you are not sure whether you have created a DHL easySHOP account in the past, you can click on "Forgot Account Number or Password?" and enter your email address.

If you still can't access your account, contact Customer Service. Don't re-register for another account; only one account per customer is permitted.

- I haven't received an email confirming my registration

Please make sure that your spam filter doesn't block emails from us - you should receive an email with your Suite Number and Suite address within minutes of registering (depending on your email system). If you have a spam filter, please make sure it will allow emails from dhleasyshop.com into your inbox - otherwise we can't let you know when we receive a delivery for you!

If your spam filter is off but you still haven't received a mail from us, please contact us.

- What should I do if I suspect that my password has been stolen?

Please contact us immediately via live chat or email and we will deactivate or block your account. We will issue a new temporary password and email it to the email address that you used when you registered with DHL easySHOP. If we know or suspect you have been responsible for a security breach or if there is suspected fraudulent use of your account, we may not permit you to open a new account.

Be sure you safeguard your password and don't let anyone else have it! You are responsible for all use of your account made under your login and password.

If you have simply forgotten your password or are unable to access your account, see FAQ Help! I can't get into my account

- Are there any restrictions on joining DHL easySHOP?

You must be at least 18 years old (or the legal age of adulthood in your country, at which age you are able to enter into contracts) to open a DHL easySHOP account and use DHL easySHOP services.

Also, you must have received any necessary permissions to open a DHL easySHOP account (for example, if you use your employer's email service), and you must agree to comply with the DHL easySHOP Terms and Conditions.

You may only open one DHL easySHOP account, and only one Suite address is allowed per customer.

- How do I change my password?

It's easy to update your personal details with DHL easySHOP. Follow the steps below:

- Login to your DHL easySHOP account with your suite number and password

- Click the My Account button and then click on Change Account Details

- Enter the new information you wish to change

- Click Next to confirm the new changes

- Why can't I enter my suite number in an online order form?

Your DHL easySHOP Suite Number is essential to ensure delivery of your goods. Depending on the Merchant you are buying from, you may have to enter it after your name, or in address line 1. If you are getting an error message, try replacing the hyphen (-) between the two numbers with a space.

If a Suite number is not included on the delivery address, we may have difficulty identifying that it is your package and additional fees may apply

If you are expecting a package but haven't received a "New Delivery" notice from DHL easySHOP, contact Customer Support. That will help us locate your package if the Merchant didn't include the correct Suite number on the address label.

- How do I close my account?

We value your business and we'd be sorry to see you go. Sometimes members think they need to close their account because they don't know how to solve a problem. Before you decide to close any of your accounts, we'd like to help you solve any problem you might be having. You may contact customer service and they will be happy to assist you with any queries or close your account on your behalf.

- How can I change the registered email address of my existing account?

If you wish to change your email address, please log into your DHL easySHOP account and select "Change my Email"

- I have moved to another country! How can I change my country?

If you have already used our service, you will not be able to change the country. Please contact Customer Service to have your existing account closed and you may then proceed in opening a new account.

- Why Did My DHL easySHOP Address Change?

US HUB - On May 25, 2018, we moved our export facility from Lockbourne, Ohio to a larger warehouse in Newark, Delaware.

DE HUB - Starting February 19, 2018, our German export facility will be moved to a different building within the same complex. This means your German address building number has changed from 555C to 579A.

What to know

- Where can I find the new address? The new address can be found in the "My suite addresses" section of your Borderlinx dashboard. Your unique suite number has not changed.

- When should I start using the new hub address? Immediately. All future shipments should be addressed to your new hub address.

- I currently have shipments being delivered to the old address. What do I do? To avoid delays, please make sure orders placed are shipped to the updated address. Orders sent to the old address will be transferred to the new hub location within 2-5 days.

- Import Duty explained

Wonder how the customs taxes and duties work? Without getting into all the terminologies and legal complexities of customs regulations, we'll summarise the essentials for you

All imported goods and their values must, by law, be declared to the importing country's customs authority. If an item is wrongly described or an inaccurate value is stated, customs authorities may impose penalties and, in serious cases, there might even be criminal proceedings.

As the "Importer", you are responsible for complying with customs laws and regulations. DHLEasyShop simplifies the process for you. We complete the customs forms with the appropriate product classification and value – based on the information you provide.

Most times, the information is available from the merchant's invoice or packing slip accompanying the package. If the merchant doesn't include paperwork describing the product and the price you paid, DHL easySHOP will request you to e-mail us a copy of the merchant's order confirmation. See FAQ How is customs duty calculated?.

We offer a Duty Delivered Paid service. So once we have the relevant information and you have paid the cost of shipping (including duty and tax) we'll pass your payments for all the taxes and duties to the relevant customs authorities.

Oh, and don't forget, some countries have a duty free concession where goods below a certain value can be imported without duty and/or tax. See FAQ What is the duty free limit for imports?.

- What is the dutiable value for Second hand goods?

The dutiable value for second-hand goods is the price you paid for the goods.

- Can I buy direct from DHL easySHOP?

We don't sell goods - just our world class service! Any goods you buy must be paid for directly with the merchant, and your purchase transaction is with them.

You select which items you want to buy –from one of the many, many US and European websites that offer an amazing array of products.

We are responsible for getting your purchases to you – we handle export and import processes, payment of duty and tax on your behalf, and deliver your goods to you.

We are not responsible for any problems you experience with a Merchant or for any defects in the goods you buy.

- Will American electrical products work here?

North America operates on 110/125 volt Alternating Current (AC). However, most of the world operates on 220/250V AC. In order to use a North American appliance abroad, it is necessary to convert (or step-down) the 220/250 volts with either a converter or transformer.

Dual voltage/worldwide voltage appliances (i.e. 100/240V, 110/220V or 120/250V) are capable of being used on 110/120V and 220/250V and do not require a converter or transformer - all you may need is the proper adapter plug(s). If you are unsure about your appliance, always check with the appliance manufacturer.

US single volt (i.e. 110/120V) appliances operate only on 110/120 volts and require the use of a converter or a transformer when used outside the US.

A list of international voltages operating in most countries can be found at http://www.worldstandards.eu/electricity/plug-voltage-by-country .

You should also be aware that there are differences in video standards around the world. Depending on your country, your purchase may or may not be compatible with other video equipment or broadcast video signals.

- Will you deliver to a PO Box?

Unfortunately we do not. We require a full street address and a contact phone number. In that way we ensure to provide you with a better service and reliable delivery of your goods

You can easily make any changes for the last mile delivery using the DHL On Demand Delivery platform

- Can I use my DHL easySHOP Suite address to receive mail?

No, sorry, we are not a mail forwarding agency. You may only use your DHL easySHOP Suite address as the local delivery address for products you buy from merchants in the US and the UK.

We dispose of any catalogues, magazines or promotional materials addressed to your DHL easySHOP address.

If you need to move documents urgently from other countries then you should use the standard services of DHL Express

- I am considering importing goods for re-sale. Is there anything I need to know?

Some Merchants prohibit their customers from reselling products. If the Merchant's website states "Not for Resale" or similar language, you should not order products from that Merchant with the intent to resell them. You should also honour any other terms of sale specified by the Merchant.

Some countries have laws or regulations restricting the resale of imported products. You need to check the laws of your country and comply with those restrictions.

If you do buy products for resale, then depending on the country where you are located you may need special VAT or import tax registration or licenses. Please check your country's import requirements.

Any shipments that appears to be imported for resale (e.g., multiple copies of the same or similar items) may be delayed by customs.

Generally if you intend to import and re-sell within the GCC you will need a valid CR (Company Registration)